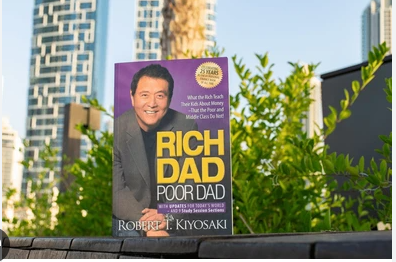

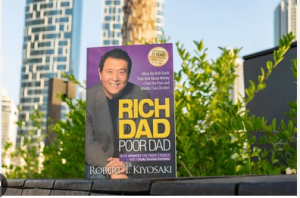

Rich Dad Poor Dad by Robert Kiyosaki is more than a personal finance book—it’s a mindset shift. Since its release, it has challenged traditional beliefs about money, work, and success, helping millions rethink how wealth is truly built.

Instead of teaching people how to earn more, the book focuses on how to think differently about money.

The Two Dads: Two Money Mindsets

The core lesson of the book is the contrast between two fathers:

-

Poor Dad represents the traditional mindset:

Go to school, get good grades, find a safe job, and work for money. -

Rich Dad represents the wealthy mindset:

Learn how money works, build assets, and make money work for you.

This comparison shows that financial success is more about mindset and education than income level.

Assets vs. Liabilities: The Rule That Changed Everything

One of the most powerful lessons in Rich Dad Poor Dad is the difference between assets and liabilities.

-

Assets put money in your pocket

-

Liabilities take money out of your pocket

Many people believe their house, car, or expensive lifestyle makes them wealthy. Kiyosaki explains that true wealth comes from owning income-generating assets such as businesses, real estate, and investments.

Why Financial Education Matters More Than Job Security

Schools teach people how to be employees—but rarely teach how money works.

Kiyosaki emphasizes that financial education is the foundation of freedom. Without understanding cash flow, taxes, and investing, even high earners can remain financially stuck.

The wealthy don’t rely on job security—they rely on financial intelligence.

Work to Learn, Not Just to Earn

Another key idea from the book is that your job should be a classroom.

Instead of staying in one role for safety, Kiyosaki encourages people to learn skills like:

-

Sales

-

Investing

-

Leadership

-

Business systems

These skills create long-term wealth far beyond a paycheck.

Final Thoughts

Rich Dad Poor Dad changed how the world thinks about money because it challenges comfort, security, and traditional advice.

The book’s core message is simple but powerful:

The rich buy assets. The poor and middle class buy liabilities they think are assets.

If you change how you think about money, you change what money does for you.