Achieving financial freedom is a goal many aspire to, and with strategic planning and dedication, it’s within reach. Here’s a comprehensive roadmap outlining the steps you can take in 2024 to achieve financial independence.

1. Set Clear Financial Goals

Start by defining your financial goals. Whether it’s paying off debt, saving for retirement, buying a home, or starting a business, clarity on what you want to achieve is crucial. Write down your goals, including timelines and specific amounts you need to reach.

2. Create a Budget and Stick to It

A budget is your financial blueprint. Track your income and expenses to understand where your money goes each month. Allocate funds towards savings, investments, and debt repayment. Tools like Mint, YNAB, or simple spreadsheets can help you stay organized.

3. Build an Emergency Fund

An emergency fund provides a financial safety net for unexpected expenses like medical bills or car repairs. Aim to save at least three to six months’ worth of living expenses in a separate savings account. Start small and gradually increase your savings contributions.

4. Pay Off High-Interest Debt

High-interest debt, such as credit cards or personal loans, can hinder your financial progress. Develop a debt repayment strategy, focusing on paying off debts with the highest interest rates first (the avalanche method) or smallest balances (the snowball method). Consistency is key.

5. Invest for Long-Term Growth

Investing is crucial for building wealth and achieving financial independence. Consider contributing to retirement accounts like a 401(k) or IRA, which offer tax advantages. Diversify your investments across stocks, bonds, real estate, and other assets based on your risk tolerance and financial goals.

6. Increase Your Income

Boosting your income through side hustles, freelancing, or advancing your career can accelerate your journey to financial freedom. Explore opportunities to earn additional income outside of your primary job. Invest in skills that are in demand and negotiate for higher pay when possible.

7. Live Below Your Means

Living below your means is a fundamental principle of financial independence. Avoid lifestyle inflation by resisting the urge to spend more as your income increases. Practice frugality by distinguishing between needs and wants, and prioritize spending on experiences or items that align with your values.

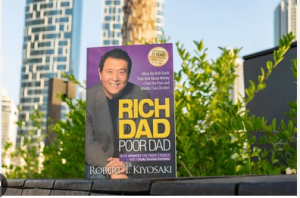

8. Continuously Educate Yourself About Personal Finance

Stay informed about personal finance concepts, investment strategies, and economic trends. Read books, follow financial blogs, listen to podcasts, and attend workshops or seminars. Understanding financial principles empowers you to make informed decisions about your money.

9. Protect Your Financial Future

Insurance plays a crucial role in protecting your financial well-being. Review your health insurance, life insurance, disability coverage, and property insurance to ensure adequate protection against unexpected events. Consider consulting with a financial advisor to tailor insurance solutions to your needs.

10. Plan for Retirement

Planning for retirement is essential for long-term financial security. Estimate your retirement needs based on your desired lifestyle and projected expenses. Maximize contributions to retirement accounts and explore additional retirement savings options such as annuities or investment properties.

11. Review and Adjust Your Plan Regularly

Financial freedom is a journey that requires ongoing evaluation and adjustment. Regularly review your financial goals, budget, investments, and overall progress. Celebrate milestones and be prepared to adapt your plan as circumstances change or new opportunities arise.

Achieving financial freedom in 2024 is attainable with disciplined financial management, strategic planning, and a commitment to your goals. By following this roadmap—setting clear goals, budgeting wisely, saving and investing prudently, increasing income, and protecting your financial future—you can pave the way towards financial independence. Start implementing these steps today and embark on a path to a more secure and prosperous future.

3.5